Time to Re-Enter Corporate Bonds?

In the past year, credit spreads have widened for various reasons—most recently, concerns over the U.S. banking crisis—which present a good entry point for investors looking for higher-yielding fixed income products. Portfolio Manager Matt Montemurro explores the new BMO Corporate Bond ETF Fund and its advantages.

May 2023

Key Takeaways

- A one-ticket solution for targeted exposure to investment grade Canadian corporate bonds at a target MER of 0.17% for the F-Series1

- Fund invests 100% of assets in the BMO Corporate Bond Index ETF (ticker: ZCB), with an annualized distribution yield of 3.94%, as of April 28, 20232, which is higher than the BMO Aggregate Bond Index ETF (ticker: ZAG) at 3.47%

- The underlying ETF has a lower duration than the broad market3

What is the rationale for offering the BMO Corporate Bond Index ETF as a mutual fund? Why now?

MM As we look ahead, corporate credit spreads sit 40 to 50 basis points (bps) wider than their historical levels (versus long-term and 10-year averages),3 which presents an opportunity for investors. This tells me that the market is already pricing in some of the expected economic slowdown, and is generally more focused on downside protection. That said, I believe now is a good time to add credit to your portfolio. You’re getting in at—I’m not going to call it the bottom—but very attractive levels, allowing you to take advantage of higher yields at an excellent entry point. This is why we’re launching ZCB as a mutual fund now. The market has been quite bearish on credit for a while. As we move forward, looking to something like this fund—which provides high-quality credit exposure at an average rating of A and above—can give you a bit of insulation from potential risk-off sentiment in the market. Now, investors who want the mutual fund wrapper can get core corporate bond exposure through the BMO Corporate Bond ETF Fund at the cost of 17 bps for the F-Series,1 which is very competitive relative to its peers.

Most investors hold some type of Canadian corporate bond fund. How does this mandate improve what’s already available?

MM It provides a pure exposure. Looking at historical returns, you can see that the fixed income universe is very range bound. Over the long term, such index-based funds have performed extremely well in all types of environments. Looking forward, I think there will be an overall tightening of credit spreads rather than issue-specific ones—and if we see that, the Fund is well positioned for the market ahead. The exposure we provide is diversified across issuer and issue—you can take advantage of the full term and focus on all corporate bonds—with lower duration than the broad market at 5.87 years3 and a fee of just 17 bps. Again, if you’re looking at the fee differential between other funds in this category, it will be meaningful on a year-over-year basis.

Is this strategy intended to be a core or satellite holding?

MM You can look at it as a core holding within the corporate allocation of your portfolio. But in terms of your overall fixed income, it is more of a satellite holding. Many investors want to take advantage of the yield premium from corporate bonds, and this fund provides full-term exposure—short, mid and long—in order to do so across the curve. Typically, this is what you want to complement the downside protection of a diversified government bond exposure, such as the BMO Aggregate Bond ETF Fund. Then, as an added layer, you can include other funds at specific areas of the yield curve or maybe sub-investment grade or international fixed income. Although this fund has a little bit more risk than your traditional core because of its corporate exposure, I believe many Advisors prefer taking advantage of that corporate spread premium and higher yield.

The fund invests 100% of its assets into an ETF. How has the underlying ETF performed since its inception in 2018?

MM The last two years were challenging for fixed income as a whole. In 2022, the Canadian universe saw the worst returns on record as stocks and bonds dipped at the same time in what many would call an “outlier event.” It has only happened three times in 150 years. However, our ETF tracked tight to the index with a strong relative performance for the most part. Since its inception, we have seen a total return of just under 8%.4 Also, over time, investment grade corporate bonds tend to outperform the underlying aggregate market. In the short-term, unforeseen events can happen—like last year—and you can see some underperformance here and there as credit spreads settle. The longer-term has shown otherwise, and you’re going to see that with the Fund as well.

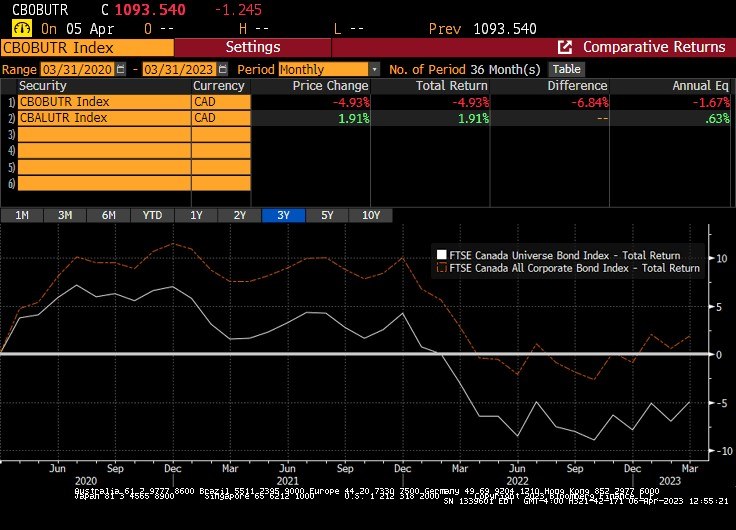

Canadian All Corporate Bond Index vs. Broad Canadian Bond Market

Source: BMO Global Asset Management, Bloomberg, FTSE Canada Universe Bond Index versus FTSE Canada All Corporate Bond Index over the long term: three, five and 10-year periods, from 2013 to 2023. Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

The portfolio holds over 850 corporate bonds across Canada. Can you break down the composition of sectors, duration and credit quality?

MM Certainly. The top three sectors are Financials at about 40%, Energy at roughly 21.5% and Infrastructure at around 15.5%. Then, it’s pretty well diversified across the remaining sectors. Obviously, the Canadian market is financials-heavy, but you’re still getting 60% exposure to other sectors. On average, the credit quality of the Fund is A. As expected, in the corporate space, you’re getting a large portion of the A to BBB range. Essentially, that’s how you take advantage of the spread premium compared to the aggregate universe. In terms of the weighted average duration, it’s about 5.8 years.5 While a little on the shorter end compared to something like ZAG, you are getting moderate duration exposure. Not going super long makes sense, given the nature of the corporate universe. I would say it’s an opportune period for corporate bonds, as we could see spreads tighten.

Source: BMO Global Asset Management, as of May 1, 2023.

What types of investors—retirees, near-retirees or younger—do you think can benefit from having this fund in their portfolio?

MM I think the Fund is for anyone looking for an additional yield premium with moderate risk. You’re going to see more volatility relative to, let’s say, a shorter-term product. But I believe this is an attractive solution for investors looking to balance diversification and stability with yield. It’s an allocation that can fit in many people’s portfolios—whether you are a retiree or just starting out. What’s important is that you’re getting that yield enhancement to capture those income needs.

We often ask our portfolio managers to recommend a book or podcast for our Advisor audience. Matt, you gave us a “good read” in your April article, How to Save 86% on Your Core Fixed Income Fees*. What have you been listening to lately?

MM As it happens, the same author, Dr. Mark Hyman, also produces an exceptional podcast called The Doctor’s Farmacy. The series gives a different perspective on the foods we eat and insights into our brain function to help us live healthier, happier lives—whether it’s by breaking bad habits, reducing stress or increasing energy levels. Episodes vary in length, with some being only 20 minutes and others more than an hour, depending on the topic and there are hundreds—plenty of intriguing conversations and great wellness tips.

Please contact your BMO Global Asset Management wholesaler for any additional support and guidance.

1 Target MER – Management Expense Ratio is an estimate only as this fund is less than one year old.

2 Annualized Distribution Yield: The most recent regular distribution, or expected distribution, (excluding additional year-end distributions) annualized for frequency, divided by current NAV.

3 Bloomberg, as of February 28, 2023.

4 Bloomberg, BMO Global Asset Management, as of April 28, 2023. ZCB Annualized Performance – 1-year: -1.09%; 3-year: 0.32%; 5-year: 1.28%; Since Inception: 1.33%. Inception Date: March 2, 2018.

5 BMO Global Asset Management, Bloomberg, as of April 21, 2023. Duration: A measure of sensitivity of bond prices to changes in interest rates. For example, a 5-year duration means the bond will decrease in value by 5% if interest rates rise 1% and increase in value by 5% if interest rates fall 1%. Generally, the higher the duration, the more volatile the bond’s price will be when interest rates change.

Disclosures:

IMPORTANT DISCLAIMERS

FOR ADVISOR USE ONLY. No portion of this communication may be reproduced or distributed to clients as it may not comply with Sales Communications requirements.

Commissions, management fees and expenses (if applicable) all may be associated with investments in mutual funds. Trailing commissions may be associated with investments in certain series of securities of mutual funds. Please read the fund facts, ETF facts or prospectus of the relevant mutual fund before investing. The indicated rates of return are the historical compounded total returns including changes in share or unit value and the reinvestment of all dividends or distributions and do not take into account the sales, redemption, distribution, optional charges or income tax payable by the unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. ETF Series of the BMO Mutual Funds trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

As the funds are less than one year old, actual Administrative and Trading Expense Ratio costs will not be known until the Fund Financial Statements for the current fiscal year are published. The Target MER is an estimate only of expected fund costs until the completion of a full fiscal year, and is not guaranteed.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The information in this trade idea is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

This communication is intended for informational purposes only and is not, and should not be construed as, investment and/or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment.

The payment of distributions is not guaranteed and may fluctuate. The payment of distributions should not be confused with an Exchange Traded Fund’s performance, rate of return or yield. If distributions paid by the Exchange Traded Fund are greater than the performance of the Exchange Traded Fund, your original investment will shrink. Distributions paid as a result of capital gains realized by an Exchange Traded Fund, and income and dividends earned by an Exchange Traded Fund are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero. Please refer to the Exchange Traded Funds, distribution policy in the prospectus.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain of the products and services offered under the brand name, BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations. BMO Financial Group is a service mark of Bank of Montreal (BMO).

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from Bank of Montreal. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the prospectus before investing.

Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

Commissions, trailing commissions (if applicable), management fees and expenses all may be associated with mutual fund investments. Please read the ETF facts, fund facts or prospectus of the relevant mutual fund before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. ETF Series of the BMO Mutual Funds trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

Distribution yields are calculated by using the most recent regular distribution, or expected distribution, (which may be based on income, dividends, return of capital, and option premiums, as applicable) and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value (NAV). Distributions are not guaranteed, may fluctuate and are subject to change and/or elimination. Distribution rates may change without notice (up or down) depending on market conditions and net asset value (NAV) fluctuations. The payment of distributions should not be confused with a BMO Mutual Fund’s performance, rate of return or yield. If distributions paid by a BMO Mutual Fund are greater than the performance of the investment fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a BMO Mutual Fund, and income and dividends earned by a BMO Mutual Fund, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

Distributions, if any, for all series of securities of a BMO Mutual Fund (other than ETF Series) are automatically reinvested in additional securities of the same series of the applicable BMO Mutual Fund, unless the securityholder elects in writing that they prefer to receive cash distributions. For further information, see the distribution policy for the applicable BMO Mutual Fund in the simplified prospectus.

Legal and regulatory disclosures

This information is for Investment Advisors only. By accepting, you certify that you are an Investment Advisor. If you are NOT an Investment Advisor, please decline and view the content in the Investor or Institutional areas of the site. The website is for informational purposes only and is not intended to provide a complete description of BMO Global Asset Management’s products or services. Past performance is not indicative of future results. It should not be construed as investment advice or relied upon in making an investment decision. Products and services of BMO Global Asset Management are only offered in jurisdictions where they may be lawfully offered for sale. The information contained in this Website does not constitute an offer or solicitation by anyone to buy or sell any investment fund or other product, service or information to anyone in any jurisdiction in which an offer or solicitation is not authorized or cannot be legally made or to any person to whom it is unlawful to make an offer of solicitation. All products and services are subject to the terms of each and every applicable agreement. It is important to note that not all products, services and information are available in all jurisdictions outside Canada.