Three Ways to Invest in Tech

There isn’t only one way to invest in technology. With artificial intelligence and other innovations poised to change the way we work and live, Francois Lachance, BMO Global Asset Management’s Director, Intermediary Distribution, Quebec, breaks down three strategies that may offer your clients access to the next industrial revolution.

May 2023

Francois Lachance

Director, Intermediary Distribution, Quebec

The next industrial revolution

Over the last several months, ChatGPT has taken the world by storm. It was a development that at once seemed inevitable and shocking: for years, we’ve been hearing about the potential of artificial intelligence (AI), but few of us expected to see something so capable emerge so suddenly. From the various exams it is reported to be capable of passing—running the gamut from a sommelier test to a Wharton MBA final assessment—to teachers’ concerns about the impact ChatGPT will have on the education system, AI is already changing the way the world works. This begs several questions that Advisors may already be hearing from clients, including: if this is the impact that emergent technologies can have in only a few months, what kind of longer-term changes will they bring about? And what will it all mean for tech companies and investors?

In the market cycle, Technology tends to lead—even before last year, it was the first sector to be hit by inflation, and in 2023, it’s been among the first to rebound. In the longer term, it is the belief of BMO Global Asset Management (GAM)’s Global Equity team, which includes tech sector specialists, that innovation, and AI in particular, will serve as the basis for the next industrial revolution—and that this revolution will offer significant opportunities for investors. But as Advisors well know, not all investors are alike; they may have different goals, time horizons, and risk tolerances. Many client portfolios already have exposure to the FAANG companies—Facebook (now Meta), Apple, Amazon, Netflix, and Google (now Alphabet)—as individual stock holdings, and while this certainly isn’t a bad thing, it does leaves portfolios exposed to diversification risk and reduces potential gains from the next market leaders. These are all among the reasons BMO offers several different ways to invest in tech depending on your client’s particular situation. Here are three solutions worth considering:

In the market cycle, Technology tends to lead.

BMO Nasdaq 100 Equity ETF Fund: One-ticket exposure to the tech universe

The BMO Nasdaq 100 Equity ETF Fund is a core growth portfolio holding offering exposure to effectively the entire tech universe through its index approach. This strategy and the fund’s Medium risk rating differentiate it from actively-managed and/or higher-risk tech solutions, and make it well-suited for a broader range of client portfolios.

The Nasdaq-100 is a capitalization-weighted, ex-Financials index, meaning that the fund’s exposure is mainly focused on mature tech companies—names like Microsoft, Apple, and Alphabet (Google). These types of corporations tend to generate very strong earnings with many of them also engaged in stock buybacks, offering strength and comparative stability as part of a diversified portfolio. The bulk of the underlying mandate’s exposure is in the Information Technology (55%) and Consumer Discretionary (20%) sectors1.

Among the fund’s most attractive features is the Nasdaq-100 index’s long track record of relative outperformance versus the S&P 500—which, needless to say, is not an easy index to beat. In fact, as the chart below illustrates, the Nasdaq-100 has outperformed the S&P 500 in 12 of the past 15 calendar years.

BMO Global Innovators Fund: A multi-sector approach to innovation investing

The BMO Global Innovators Fund offers access to a high-conviction portfolio of approximately 50-60 companies involved in the development of innovative products, processes or services. It is actively managed by BMO GAM’s award-winning2 Global Equity team and carries a Medium risk rating.

The Global Equity team’s years of experience has led them to a key insight which underpins the Global Innovator Fund’s strategy: innovation is not the exclusive domain of the Technology sector. In fact, innovation has exploded in all industries as companies transform into digital businesses. The BMO Global Innovator Fund’s holdings reflect that philosophy, representing a broader spectrum of sectors than other innovation-focused solutions. The emphasis is not only on companies that have done well lately, but on emerging trends in innovation, asking the question—who will be leading the way over the next decade?

In innovation investing, timing is everything, and it’s best to be early. That’s the difference that the Global Equity team makes: they’ve dedicated decades of work to developing a global network to assist them in finding and evaluating the most innovative companies in the world. This gives them a radar-like ability to identify emerging trends at an early stage and best determine where to allocate the fund’s investment dollars.

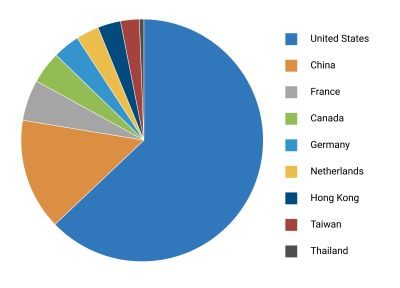

The BMO Global Innovator Fund’s strategy is underpinned by three themes—Artificial Intelligence, the Reopening of the Global Economy, and Networking & Connectivity—and offers the benefits of geographic diversification. Whereas the Nasdaq-100 is overwhelmingly comprised of US-based companies, the BMO Global Innovators Fund includes holdings from many different countries:

Innovation is Happening Everywhere

BMO Global Innovators by Country of Risk

NASDAQ 100 by Country of Risk (NDX)

Source: BMO GAM, Bloomberg Finance L.P., NDX Index, as of February 28th 2023

BMO ARK Innovation Fund: Investing in the future today

The BMO ARK Innovation Fund’s strategy differs significantly from the BMO Nasdaq 100 Equity ETF Fund and the BMO Global Innovators Fund in that it has no exposure to the FAANG companies. Aside from Tesla, which ARK founder Cathie Wood sees as the likely leader of an impending robotaxi boom3, ARK’s focus is on emerging innovators rather than mega-cap names, with a greater allocation to Health Care and an underweight to Information Technology relative to the Nasdaq-100. It is somewhat more concentrated than the previous two strategies profiled, both in terms of the number of holdings in its portfolio and the weight allocated to its top holdings, and it carries a High risk rating.

ARK’s approach is driven by Cathie Wood’s forty-plus years of experience identifying and investing in “disruptive innovation,” which ARK Invest defines as “the introduction of a technologically enabled new product or service that potentially changes the way the world works.”4 Rather than focusing on particular sectors or geographies, ARK’s team of analysts are organized according to five innovation themes:

- Artificial intelligence

- DNA sequencing

- Robotics

- Energy storage

- Blockchain

In the same way that three technological breakthroughs—the telephone, the automobile, and electricity—enabled the rapid transformation of society in the late nineteenth century, Wood and ARK believe that these five platforms are poised to lead the global economy as it undergoes the greatest technological transformation in history.

Comparison – three tech strategies:

| Fund | Fund code (Series F) | Management (Active vs. Passive) | MER | Risk rating |

|---|---|---|---|---|

| BMO Nasdaq 100 ETF Fund | BMO95120 | Passive | 0.40% | Medium |

| BMO Global Innovators Fund | BMO95164 | BMO40164 (USD) | Active | 0.99%* | Medium |

| BMO ARK Innovation Fund | BMO95265 | Active | 0.85%* | High |

Source: BMO Global Asset Management, Bloomberg, as of April 30, 2023.

* Management Expense Ratio (MER) is estimated as Fund is less than one year old.

Top holdings:

| BMO Nasdaq 100 ETF Fund | BMO Global Innovators Fund | BMO ARK Innovation Fund |

|---|---|---|

| Microsoft 13.4% | Meta 5.3% | Tesla 10.3% |

| Apple 12.7% | Apple 4.0% | Roku 7.7% |

| Amazon 6.3% | Alphabet (Class A) 3.3% | Zoom 7.4% |

| NVIDIA 5.2% | Microsoft 3.1% | Coinbase 6.1% |

| Meta 4.1% | NVIDIA 3.0% | Block 5.8% |

| Alphabet (Class A) 3.8% | EDU 2.9% | Exact Sciences 5.6% |

| Alphabet (Class C) 3.8% | Trip.com 2.8% | UiPath 5.3% |

| Tesla 3.0% | Baidu 2.8% | DraftKings 4.8% |

| PepsiCo 2.0% | Shopify 2.8% | Shopify 4.6% |

| Broadcom 2.0% | Shell 2.7% | Teladoc Health 4.5% |

| Top 10 Weight 56.3% | Top 10 Weight 32.7% | Top 10 Weight 62.1% |

| Total Holdings 101 | Total Holdings 48 | Total Holdings 27 |

Source: BMO Global Asset Management, Bloomberg, as of April 30, 2023.

Please contact your BMO Global Asset Management wholesaler for any support and guidance.

1 BMO Global Asset Management, as of May 2023.

2 TopGun Investment Minds Platinum Class winners 2021/2022 – Platinum Class Winners, Malcolm White, Jeremy Yeung. Platinum Class awarded to individuals who have been Designated TopGun in four consecutive years.

Disclosures:

FOR ADVISOR USE ONLY. No portion of this communication may be reproduced or distributed to clients as it may not comply with Sales Communications requirements.

This communication is intended for informational purposes only and is not, and should not be construed as, investment and/or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment.

Nasdaq-100 Index® is a registered trademark of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by the Manager. The Mutual Fund has not been passed on by the Corporations as to their legality or suitability. The Mutual Fund is not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the Mutual Fund.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

Commissions, trailing commissions (if applicable), management fees and expenses all may be associated with mutual fund investments. Please read the fund facts or prospectus of the relevant mutual fund before investing. The indicated rates of return are the historical annual compounded total returns for the period indicated including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Distributions are not guaranteed and are subject to change and/or elimination.

For a summary of the risks of an investment in BMO Mutual Funds, please see the specific risks set out in the prospectus.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain of the products and services offered under the brand name, BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations. BMO Financial Group is a service mark of Bank of Montreal (BMO).

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from Bank of Montreal. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the prospectus before investing.

Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

Commissions, trailing commissions (if applicable), management fees and expenses all may be associated with mutual fund investments. Please read the ETF facts, fund facts or prospectus of the relevant mutual fund before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. ETF Series of the BMO Mutual Funds trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

Distribution yields are calculated by using the most recent regular distribution, or expected distribution, (which may be based on income, dividends, return of capital, and option premiums, as applicable) and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value (NAV). Distributions are not guaranteed, may fluctuate and are subject to change and/or elimination. Distribution rates may change without notice (up or down) depending on market conditions and net asset value (NAV) fluctuations. The payment of distributions should not be confused with a BMO Mutual Fund’s performance, rate of return or yield. If distributions paid by a BMO Mutual Fund are greater than the performance of the investment fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a BMO Mutual Fund, and income and dividends earned by a BMO Mutual Fund, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

Distributions, if any, for all series of securities of a BMO Mutual Fund (other than ETF Series) are automatically reinvested in additional securities of the same series of the applicable BMO Mutual Fund, unless the securityholder elects in writing that they prefer to receive cash distributions. For further information, see the distribution policy for the applicable BMO Mutual Fund in the simplified prospectus.

Legal and regulatory disclosures

This information is for Investment Advisors only. By accepting, you certify that you are an Investment Advisor. If you are NOT an Investment Advisor, please decline and view the content in the Investor or Institutional areas of the site. The website is for informational purposes only and is not intended to provide a complete description of BMO Global Asset Management’s products or services. Past performance is not indicative of future results. It should not be construed as investment advice or relied upon in making an investment decision. Products and services of BMO Global Asset Management are only offered in jurisdictions where they may be lawfully offered for sale. The information contained in this Website does not constitute an offer or solicitation by anyone to buy or sell any investment fund or other product, service or information to anyone in any jurisdiction in which an offer or solicitation is not authorized or cannot be legally made or to any person to whom it is unlawful to make an offer of solicitation. All products and services are subject to the terms of each and every applicable agreement. It is important to note that not all products, services and information are available in all jurisdictions outside Canada.