Make International Great Again: Time to (re)embrace international equity diversification

April 2025

“Diversification, the only free lunch in investing” – Harry Markowitz

- President Trump’s America First agenda is forcing a powerful policy rethink among key trade partners. The implications for the U.S. dollar and non-U.S. growth strengthen the case for regional equity diversification following decades of significant U.S. equity outperformance.

- Tactically, international equities generally outperform when the U.S. dollar (USD) weakens and global growth picks up. We think the USD is peaking and that we are nearing peak trade uncertainty.

- From a longer-term perspective, U.S. protectionism and isolationism raises the attractiveness of non-U.S. equities by incentivizing productivity-enhancing investment. U.S. policy may be increasingly USD-negative in weighing on potential growth and impacting capital flows. EAFE (Europe, Australasia and the Far East), specifically Europe, looks most attractive, in our view.

Every investor knows that diversification is a good thing for portfolio construction, yet this well-established, common-sense approach to investing has struggled with a nearly three-decade long outperformance of U.S. equities versus a broad set of non-U.S. equity markets (Figure 1). The recent decade even evolved toward an anecdotal paradigm where many investors folded to the view that there was no alternative (i.e., TINA “there is no alternative”) outside of U.S. equities. The danger in investing is to expect things to go on forever. Of course, nothing can last forever when it comes to picking winning stock markets.

The Trump Reset: challenging exceptionalism while waking up the rest of the world

U.S. equities recently unwound post-election gains as President Trump prioritized growth-negative policies (tariffs, DOGE – Department of Government Efficiency, border security) and U.S. growth expectations began cooling. Though it remains difficult to forecast Trump’s next move, one assumption we can make is that these policies are means to an end and necessary to achieve Trump’s America First agenda of balancing the budget and increasing domestic manufacturing. While this may seem like the worst-case scenario for risk assets unfolding, there are powerful trends emerging that offer opportunity for investors and are by-products of Trump’s America First agenda.

International equities are having a moment

International equities generally outperform when the USD weakens and global growth picks up. We have witnessed the first leg of this trade, reflecting a rerating of extreme valuations in Europe and China as U.S. growth expectations peaked while growth started to bottom elsewhere. The USD also peaked in January.

Figure 1: Total Return of U.S. vs Non-U.S. Developed Equities

Source: Global Financial Data, Bloomberg, BMO GAM. Data as of February 28, 2025.

Lasting periods of international outperformance have not occurred in over two decades (Figure 1). What is required is sustained USD depreciation and growth convergence led by non-U.S. countries. Tactically, we think USD has peaked, as U.S. growth downgrades keeps the U.S. Federal Reserve (“Fed”) rate cut cycle intact (Figure 2). The sum of Trump policies could prove most negative for U.S. growth than elsewhere even though the U.S. is least exposed to trade, driving a negative USD premium similar to what occurred for the Pound sterling (GBP) after Brexit. Finally, trade uncertainty is likely peaking, allowing currency premiums to fade and global growth to recover in the second half of the year.

Figure 2: USD has likely peaked if the Fed continues cutting

*target interest rate level (for a cycle of rate hikes/cuts) set by the Fed

Source: Bloomberg, BMO GAM, March 2025.

Furthermore, Trump’s protectionist agenda is incentivizing U.S. key trade partners to invest more in defense and implement more growth-friendly domestic policies. This is already playing out in Europe, where Germany has reformed its “debt brake” and passed massive spending packages on defense and infrastructure to the tune of 20% of GDP (gross domestic product) over 10 years. The EU (European union) has also backed a “ReArm Europe” plan to spend €800bn more on defense while loosening debt restrictions on member nations. Based on fiscal multipliers of 0.5 to 1.0, the impact amounts to several percentage points on GDP growth in the next few years.

In Canada, officials are not only raising defense spending but are discussing ways to open up barriers on inter-provincial trade, which could boost GDP by at least $160bn per year, diversify exports and open up pipeline capacity.

China is a poster child for U.S. decoupling. Facing years of export controls and tariffs, China has accelerated its own innovation, subsidized domestic industry and created closer ties with other trade partners. Faced with more tariffs, China is boosting stimulus as its economy emerges from its multi-year slump, raising its deficit target to 5%, the highest in 15 years, and prioritizing consumption growth. Chinese officials are again warming up to the domestic tech sector, still the only true competitor to U.S. tech and biotech and where AI-driven productivity is the second most likely place to materialize outside of the U.S. Relative to the U.S., Europe and Asia EM (emerging markets) also have the greatest exposure to China’s economic upturn.

Figure 3: Productivity gaps between U.S. are significant

Source: Haver Analytics, BMO GAM, December 31, 2024.

This policy rethink can be transformative in raising long-term bond yields, which is good for banks, and raising productivity, where gaps versus the U.S. have widened dramatically in the past 15 years (Figure 3). It comes at the same time the U.S. is pursuing policies that may weigh on productivity, through tariffs which hurts supply chains and makes capital expenditures (funds used to acquire assets) more expensive, and prioritizing domestic production, which can be more costly. In sum, higher growth prospects and bond yields help value-heavy indices like Europe and Canada.

Possible peace in the Middle east and in the Ukraine, where war dealt a significant energy shock, is an additional positive risk catalyst for non-U.S. equities. Lessons from the Ukraine war are also driving Europe to rethink its energy policy and devise ways to drive down energy costs which remain relatively high.

The case for regional diversification

We do not heavily discount U.S. growth resilience or other Trump policies around deregulation and tax reform, which are likely to come more to the forefront later this year. The main conclusion is the case for diversification, a pillar of investing, within equities has strengthened in our view, and non-U.S. equities generally provide nominal benefits (Figure 4).

Figure 4: Regional correlations* with U.S. equities show some diversification benefits

*Correlation shows the relationship between variables. Closer to +1/-1 means the variables move similarly/differently.

Source: Bloomberg, BMO GAM. Local currency, since 2010. Data as of February 28, 2025.

Portfolio implications: when strategic means tactical

We think long-term investors should pay most attention to factors that feed a strategic (i.e., multi-year horizon) investment hypothesis and avoid chasing short-term momentum. Looking beyond the policy shifts observed in the U.S. and elsewhere, which triggered the initial buying phase of equities since last October, valuation is adding to the long-term attractiveness of non-U.S. equities. Valuation discounts have the potential to narrow further while non-U.S. earnings have a chance to catch up as countries try to reduce productivity gaps.

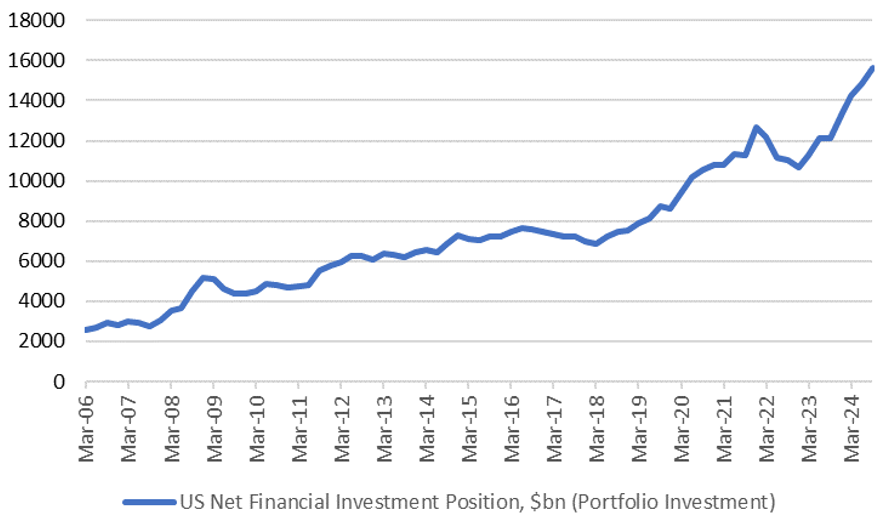

Trump’s policies—greater protectionism and fiscal austerity—have the potential to drive a sustained period of USD depreciation by impacting long-term growth and capital flows. Moreover, the fiscal policy rethink may drive a rethink among global money managers, and relocation of flows could be meaningful. Annual net flows from abroad hit a record $1.4tn through the fourth quarter of 2024, driving the U.S. net portfolio investment position to new heights with signs of some reversal in the first quarter (Figure 5).

Figure 5: Record Foreign Inflows Drives the U.S. Portfolio Investment Position to New Highs

Source: Haver Analytics, BMO GAM, December 31, 2024.

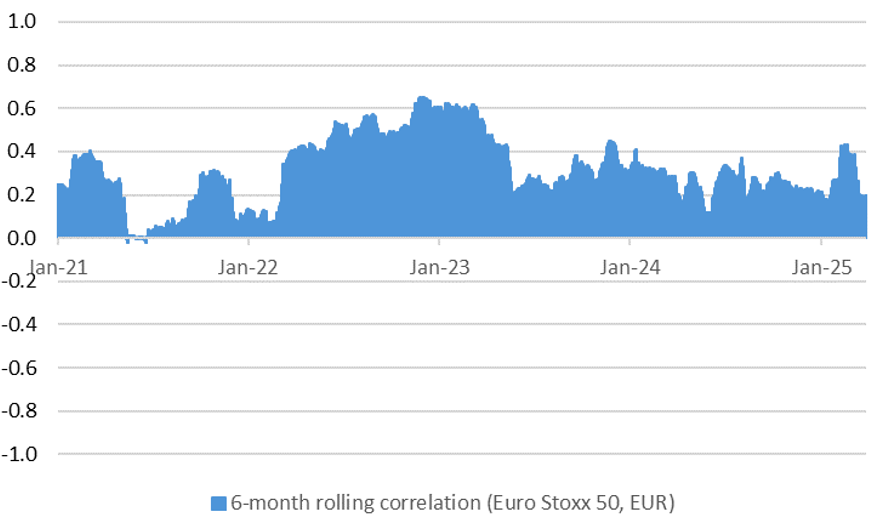

In February, we recommended investors to start hedging USD assets (see “CAD Outlook: Trade turbulence offers contrarian opportunity to hedge USD exposure”). On equity exposure, long-term investors might consider EAFE over EM, preferring the stability of democratic institutions of the former. Europe and China look most attractive tactically, the latter which we have increased to a tactical overweight in our portfolios. On Europe, we recommend Europe equities unhedged, as the new policy regime is bullish (optimistic) for the euro currency and European returns are positively correlated with changes in the euro (Figure 6).

Figure 6: European equities tend to be positively correlated with euro

Source: Bloomberg, BMO GAM, March 2025.

Disclaimers

This article is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

Published April 2025

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain of the products and services offered under the brand name, BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations. BMO Financial Group is a service mark of Bank of Montreal (BMO).

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from Bank of Montreal. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the prospectus before investing.

Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

Commissions, trailing commissions (if applicable), management fees and expenses all may be associated with mutual fund investments. Please read the ETF facts, fund facts or prospectus of the relevant mutual fund before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. ETF Series of the BMO Mutual Funds trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

Distribution yields are calculated by using the most recent regular distribution, or expected distribution, (which may be based on income, dividends, return of capital, and option premiums, as applicable) and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value (NAV). Distributions are not guaranteed, may fluctuate and are subject to change and/or elimination. Distribution rates may change without notice (up or down) depending on market conditions and net asset value (NAV) fluctuations. The payment of distributions should not be confused with a BMO Mutual Fund’s performance, rate of return or yield. If distributions paid by a BMO Mutual Fund are greater than the performance of the investment fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a BMO Mutual Fund, and income and dividends earned by a BMO Mutual Fund, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

Distributions, if any, for all series of securities of a BMO Mutual Fund (other than ETF Series) are automatically reinvested in additional securities of the same series of the applicable BMO Mutual Fund, unless the securityholder elects in writing that they prefer to receive cash distributions. For further information, see the distribution policy for the applicable BMO Mutual Fund in the simplified prospectus.

Legal and regulatory disclosures

This information is for Investment Advisors only. By accepting, you certify that you are an Investment Advisor. If you are NOT an Investment Advisor, please decline and view the content in the Investor or Institutional areas of the site. The website is for informational purposes only and is not intended to provide a complete description of BMO Global Asset Management’s products or services. Past performance is not indicative of future results. It should not be construed as investment advice or relied upon in making an investment decision. Products and services of BMO Global Asset Management are only offered in jurisdictions where they may be lawfully offered for sale. The information contained in this Website does not constitute an offer or solicitation by anyone to buy or sell any investment fund or other product, service or information to anyone in any jurisdiction in which an offer or solicitation is not authorized or cannot be legally made or to any person to whom it is unlawful to make an offer of solicitation. All products and services are subject to the terms of each and every applicable agreement. It is important to note that not all products, services and information are available in all jurisdictions outside Canada.