Lottery Tickets and Volatility: Strategies to Protect Your Client Portfolios

Flight to cash? Portfolio Manager Chris Heakes highlights how a low volatility strategy can work to protect your clients’ capital—and keep them invested.

June 2022

Key Takeaways

- Low volatility funds offer “defensive growth” to fight inflation and shaky markets

- Investors underestimate the long-term growth potential of lower beta stocks

- Low volatility funds exploit the “lottery ticket” bias in behavioral investing

After years out of favour, Low Volatility seems to be making a return. What’s driving the resurgence?

CH Well, you have to go further back in the story to understand what’s happening. Why did low volatility fall out of favour in the first place? It’s because the last couple of years have been an extremely bullish period for markets, with the economic re-openings making it worthwhile for investors to take on more and more risk. There was great excitement about the potential “return to normalcy.” Growth stocks lifted off, led by the technology sector—but then we entered a period of reckoning. Inflation proved not to be as transitory as the U.S. Federal Reserve believed, prompting central banks to begin rate hikes, and we saw geopolitical crises flare up in Ukraine. The result was a noticeable up-tick in volatility—that’s what drove the shift back to low vol assets. Investors understood that with interest rates on the rise and greater uncertainty in the world, growth would be more expensive than before.

How does a low volatility strategy balance between downside and upside protection?

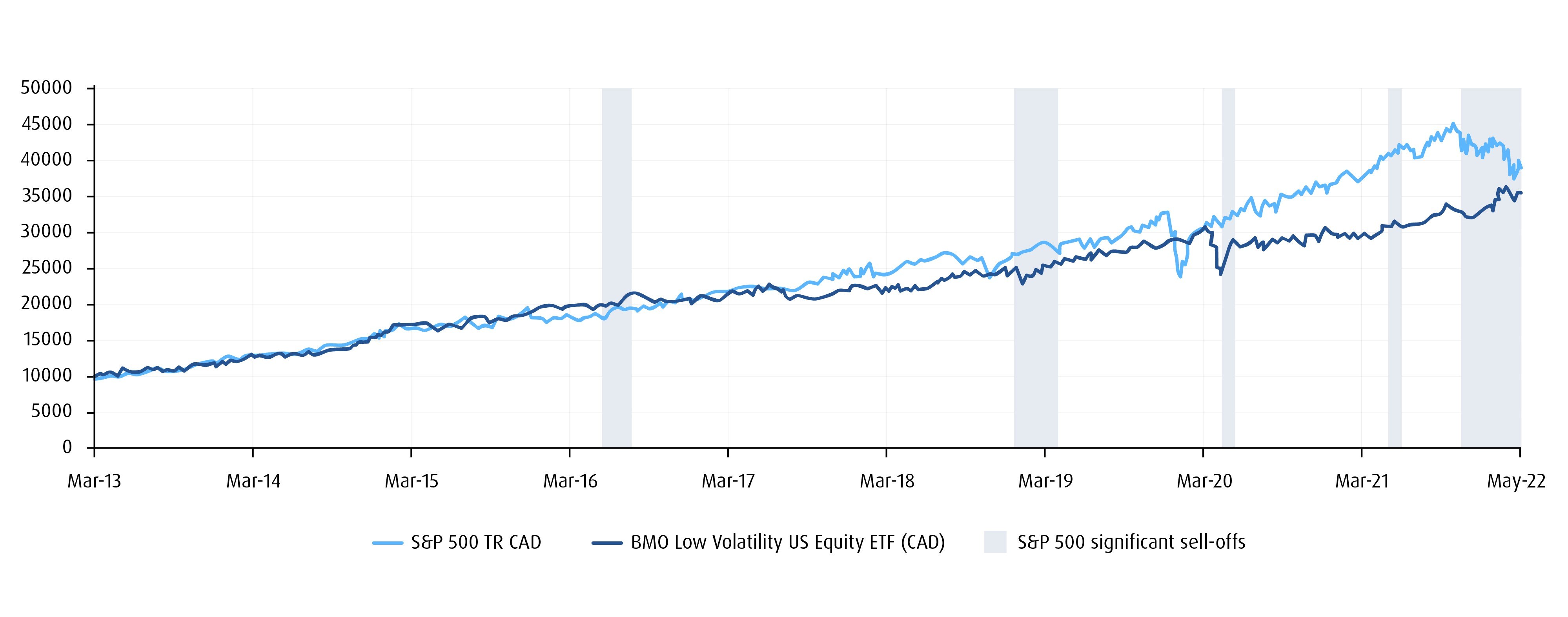

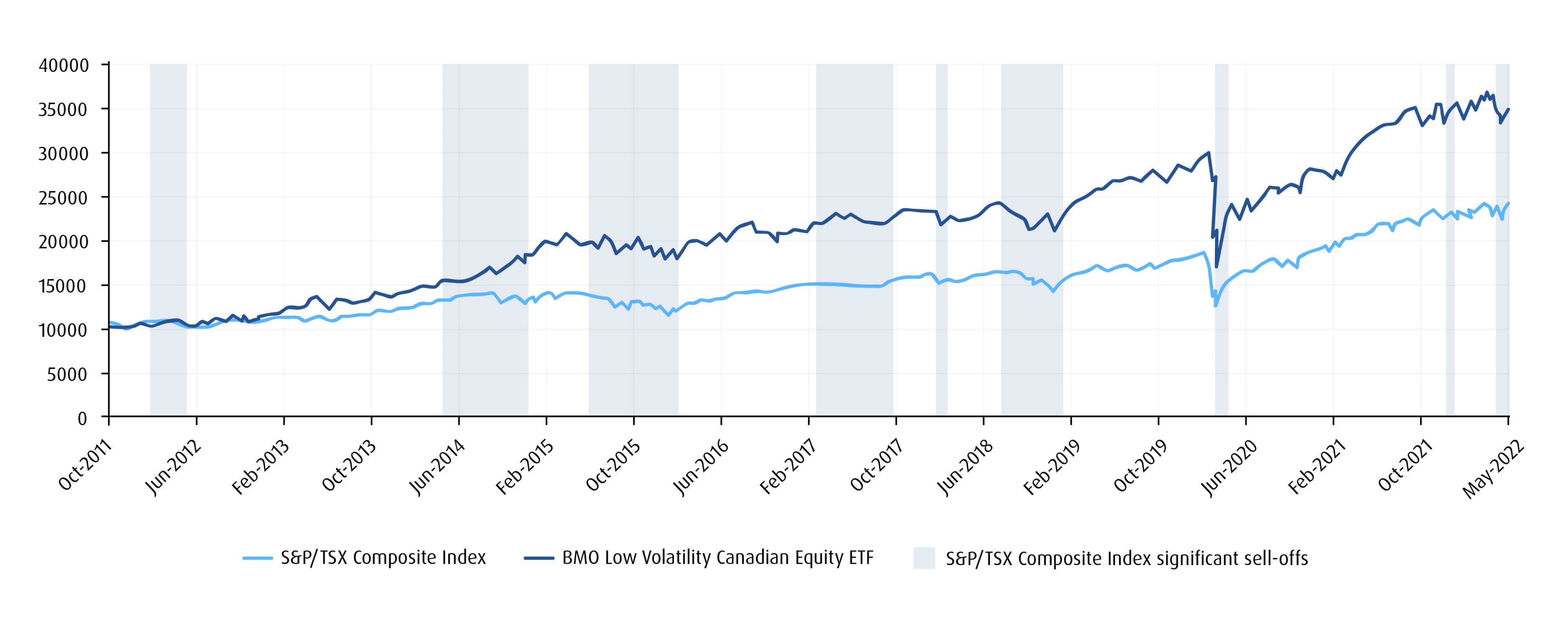

CH The downside protection story is pretty straightforward: by investing in lower beta stocks, we can reduce risk and ultimately decrease potential losses in investors’ portfolios. That’s the primary objective of these funds. But don’t underestimate the upside potential—research shows that low volatility punches above its weight class when measured across the full market cycle. As you can see below, our U.S. and Canadian Low Volatility exposures have produced capital appreciation that’s comparable to the broad market, or better. How does the strategy do both? The secret lies in behavioral investing. People generally equate risk and reward, thinking the more risk in their portfolio the better their potential returns will be. This causes them to overvalue higher-risk assets and underestimate lower-risk stocks. Some call it the “lottery ticket” phenomenon—investors see growth as a shot at huge upside, so they end up paying disproportionately more for it. By contrast, low volatility stocks go unnoticed.

100% Canadian Fund Outperforming in Up & Down Markets

BMO Low Volatility Canadian Equity ETF (ZLB) vs. S&P/TSX Composite TR Index

Performance

| Fund | 1-Year | 3-Year | 5-Year | 10-Year |

|---|---|---|---|---|

| BMO Low Volatility Canadian Equity ETF (ZLB) | 7.96% | 9.72% | 8.99% | 12.56% |

Source: Morningstar as of May 31, 2022. Inception of ZLB is Oct 2011. Inception of BMO Low Volatility Canadian Equity ETF fund is May 2019. The chart shows the performance of ZLBBMO Low Volatility Canadian Equity ETF and does not show the performance of the Mutual fund version. The Mutual fund version is a fund of fund and holds only ZLB. Index performance is provided as a benchmark but is not illustrative of any particular investment. You cannot invest directly in an index. The chart illustrates the impact to an initial investment of $10,000 dollars from October 2011 to May 2022 in the BMO Low Volatility Canadian Equity ETF. It is not intended to reflect future returns on investments in the Fund.

Performance

| Fund | 1-Year | 3-Year | 5-Year | Since Inception |

|---|---|---|---|---|

| BMO Low Volatility U.S. Equity ETF (ZLU) | 17.44% | 11.61% | 9.76% | 15.11% |

Source: Morningstar as of May 31, 2022. Inception of ZLU is March 2013. Index performance is provided as a benchmark but is not illustrative of any particular investment. You cannot invest directly in an index. The chart illustrates the impact to an initial investment of $10,000 dollars from March 2013 to May 2022 in the BMO Low Volatility U.S. Equity ETF. It is not intended to reflect future returns on investments in the Fund.

Low volatility has been called a “defensive growth” strategy. What exactly does that mean?

CH When speaking with Advisors, I often say that low volatility is about “winning by not losing”—which means that rather than aiming for the highest possible returns, you can preserve capital and keep it growing at a steady, albeit slower, pace. By protecting value during negative equity markets, the strategy is ultimately set up better for future success. Our bias is toward strong, stable businesses that perform well regardless of economic growth, high inflation and market volatility. The goal is to focus more on defensive sectors, known for “slow and steady”-type returns, and away from higher risk sectors. For instance, on the Canadian side, we have names like Metro, Hydro One and Dollarama, while for the US we have Dollar Tree, Waste Management and McDonalds. All of these equities are in a strong position today despite inflationary pressures, and benefit from consistent consumer demand, as their businesses are key to the economy.

Not all low volatility solutions are created equal. How does your investment methodology differ from other low vol funds?

CH Well, we were the first low volatility ETF provider in Canada. At the time, we completed rigorous data testing to determine whether the fund should select assets based on beta or standard deviation. We assessed the results over different timeframes, in different scenarios, with different stipulations. Ultimately, we determined that using beta over a five-year period made the most sense. We also employ a very pure construction methodology, one that isn’t concerned about market cap. Instead, we’re simply focused on the securities that offer the lowest betas. We even use a disciplined framework whereby a stock is removed from the portfolio once it falls outside our risk parameters. Finally, we avoid sector overweights by capping them at 35% for the Canadian fund and 25% for US. Our process is disciplined, rules-based and free of individual bias.

As we look ahead to more normalized times, with rates stabilizing and inflation subsiding to below its traditional 2% range, should Advisors continue to employ a low volatility strategy?

CH In a word—yes. As noted earlier, low vol can be considered a core holding for clients, with the specific weighting based on their risk tolerance and market conditions. History has shown, time and again, that it is a fool’s errand to try and time the market. No one can predict when volatility will strike. So, for investors interested in some measure of safety, having defensive growth in the portfolio can add valuable protection against a market downturn, particularly for clients who are in or nearing retirement.

Chris, we typically like to ask for a book recommendation. But we know you’re an avid podcast listener. Can you recommend one that our audience of Advisors may enjoy?

CH One of my regular listens is Trillions, from Bloomberg, which is focused on ETFs. It’s produced bi-weekly and provides a lot of valuable industry information. On a personal note, I’m also a fan of The Peter Attia Drive podcast. He’s a physician who is an expert on longevity and healthy living, and I’ve been trying to incorporate many of the concepts he discusses into my everyday life. I’m also a big proponent of tapping into the informed opinions of experts in their field, and being able to learn and grow from them.

Disclosures:

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

This communication is intended for informational purposes only and is not, and should not be construed as, investment and/or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individual’s circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment.

Index returns do not reflect transactions costs or the deduction of other fees and expenses and it is not possible to invest directly in an Index. Past performance is not indicative of future results.

S&P 500® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”) and “TSX” is a trademark of TSX Inc. These tradrks have been licensed for use by S&P Dow Jones Indices LLC and sublicensed to BMO Asset Management Inc. in connection with BMO S&P 500 Index ETF. ZSP is not sponsored, endorsed, sold or promoted by S&P Dow Jones LLC, S&P, TSX, or their respective affiliates and S&P Dow Jones Indices LLC, S&P, TSX and their affiliates make no representation regarding the advisability of trading or investing in such BMO ETF(s).

Commissions, management fees and expenses (if applicable) may be associated with investments in mutual funds and exchange traded funds (ETFs). Trailing commissions may be associated with investments in mutual funds. Please read the fund facts, ETF Facts or prospectus of the relevant mutual fund or ETF before investing. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in BMO Mutual Funds or BMO ETFs, please see the specific risks set out in the prospectus of the relevant mutual fund or ETF. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO Mutual Funds are offered by BMO Investments Inc., a financial services firm and separate entity from Bank of Montreal. BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain of the products and services offered under the brand name, BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations. BMO Financial Group is a service mark of Bank of Montreal (BMO).

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from Bank of Montreal. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the prospectus before investing.

Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

Commissions, trailing commissions (if applicable), management fees and expenses all may be associated with mutual fund investments. Please read the ETF facts, fund facts or prospectus of the relevant mutual fund before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. ETF Series of the BMO Mutual Funds trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

Distribution yields are calculated by using the most recent regular distribution, or expected distribution, (which may be based on income, dividends, return of capital, and option premiums, as applicable) and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value (NAV). Distributions are not guaranteed, may fluctuate and are subject to change and/or elimination. Distribution rates may change without notice (up or down) depending on market conditions and net asset value (NAV) fluctuations. The payment of distributions should not be confused with a BMO Mutual Fund’s performance, rate of return or yield. If distributions paid by a BMO Mutual Fund are greater than the performance of the investment fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a BMO Mutual Fund, and income and dividends earned by a BMO Mutual Fund, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

Distributions, if any, for all series of securities of a BMO Mutual Fund (other than ETF Series) are automatically reinvested in additional securities of the same series of the applicable BMO Mutual Fund, unless the securityholder elects in writing that they prefer to receive cash distributions. For further information, see the distribution policy for the applicable BMO Mutual Fund in the simplified prospectus.

Legal and regulatory disclosures

This information is for Investment Advisors only. By accepting, you certify that you are an Investment Advisor. If you are NOT an Investment Advisor, please decline and view the content in the Investor or Institutional areas of the site. The website is for informational purposes only and is not intended to provide a complete description of BMO Global Asset Management’s products or services. Past performance is not indicative of future results. It should not be construed as investment advice or relied upon in making an investment decision. Products and services of BMO Global Asset Management are only offered in jurisdictions where they may be lawfully offered for sale. The information contained in this Website does not constitute an offer or solicitation by anyone to buy or sell any investment fund or other product, service or information to anyone in any jurisdiction in which an offer or solicitation is not authorized or cannot be legally made or to any person to whom it is unlawful to make an offer of solicitation. All products and services are subject to the terms of each and every applicable agreement. It is important to note that not all products, services and information are available in all jurisdictions outside Canada.