BMO Strategic Fixed Income Yield Fund – Biweekly Update

July 18, 2025

Portfolio Manager Commentary

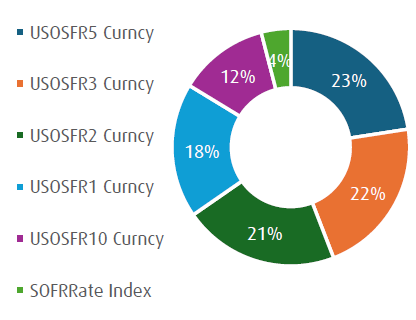

The BMO Strategic Fixed Income Yield Field (BMO SFIYF) contains a diversified suite of interest rate structured products with exposure to US rates. As of 7/14/2025, the BMO SFIYF reported a net asset value (NAV) of $9.83. The fund’s largest exposures are in 3-5y US rates with contingent coupons for range accruals are on average between 6- 9% and steepener coupons remain between 6.5-8.5%. Range accruals remain within their ranges with an average of 111bps from the tops of the range given the US rates markets rally in recent weeks.1

Recent Rates Market Movers:

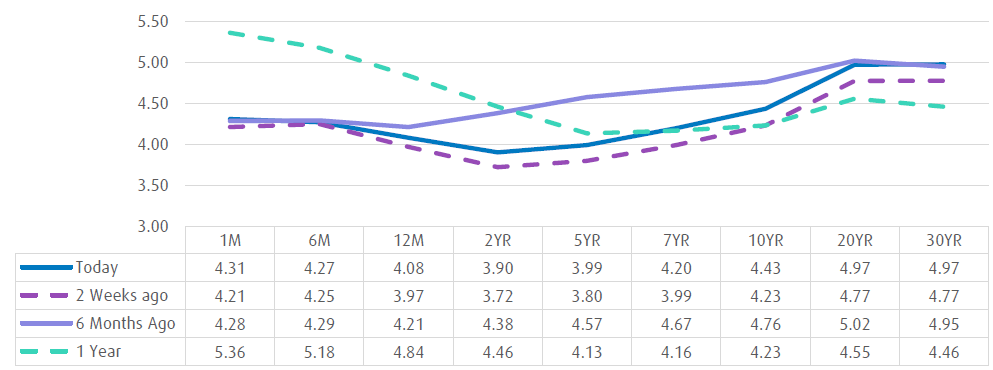

Market volatility was not as heightened during this second round of tariff talks as Trump’s tariffs relief period came to an end the week of July 7. Despite the letters sent out by the administration touting some hefty additional tariffs to 14 countries and counting, and trade tensions with Canada heating up again, markets are of the belief that these letters are the starting point for negotiation and thus rates and equity markets have not reacted as strongly as the first time around. US rates since time of last writing broke a month-long rally streak, turned around by strong US labor market data Jul 3. The jobs data was strong overall with non-farm payrolls surprising higher than expected and unemployment lower. Fed expectations were for unemployment to hit 4.5% by year-end and street consensus was 4.3%, but unemployment trended downward to 4.1% driving around a 12bps sell off in treasuries. The resilient labor market data and signs of inflation moderating continue to suggest the Fed should stay on hold for longer. That said, markets still have two cuts priced for the US by year-end, though the resilient data does not suggest rate hikes as it originally did back in December 2024. Overall, this sentiment is beneficial for BMO SFIYF as existing structures continue to collect coupons when rates remain rangebound. New interest rate structures will continue to price with attractive coupons as market uncertainty remains around when Fed will move.

Portfolio Positioning:

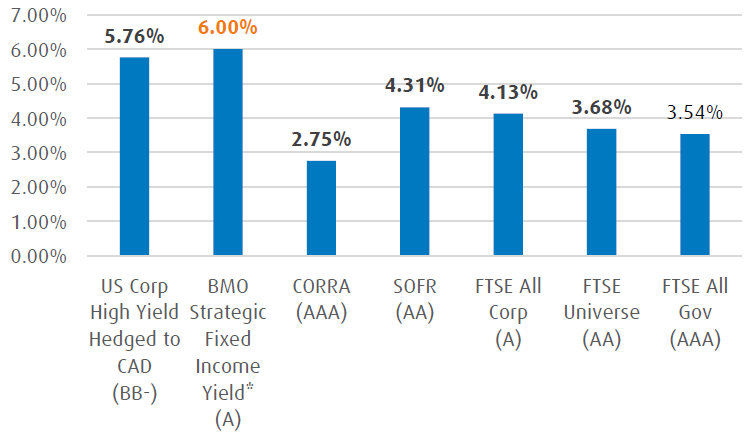

As the fund nears one year since inception, the majority of the first set of trades from initiation have been called. Three out of four range accruals have been called which has allowed PMs to deploy at coupon levels even better than when the fund was first launched, due to the increased uncertainty and thus elevated interest rate volatility. New trades replacing the underlying called tenors were on average 70bps better than previous years trades. All the other trades from the first batch of investments are within 1% of being called, with some calls not occurring due to timing. Despite higher for longer, the expectation is still for US rates to outperform. The volatility and direction thus support US interest rate structure coupons continuing to remain attractive. PMs of this fund continue using volatility spikes as opportunities to add to range accruals at favorable levels. Most recently, PMs have used called notionals to add range accruals across all tenors, these new notes have coupons between 7-8% and increased buffers of 110- 120bps. Steepeners have performed well year to date with 2s30s now at 40+bps of steepness. The PMs continue to watch for opportunities to add to these structures to take advantage of the ballooning US budget situation, the end of US exceptionalism story, and general yield curve normalization. With continued uncertainty in the US and Fed still in wait and see mode, market participants continue to monitor how this turmoil will impact lending and corporate credit. Despite the uncertainty, BMO SFIYF continues to accrue and pay out 6% annualized coupons, regardless of how credit performs. BMO SFIYF remains a good diversifier from traditional credit while still maintaining a similar enhanced coupon.

1 BMO GAM July 14 2025. Past Performance is not indicative of future results.

Fund Snapshot

| Contingent Coupon | Credit Rating |

|---|---|

| 6.0% | A |

| Average distance from the tops of the range | 111 bps |

Fund Characteristics

| Series | Fund Codes | MER (%)* |

|---|---|---|

| Advisor (CAD) | BMO99341 | 1.07 |

| F (CAD) | BMO95341 | 0.51 |

| **Low risk rating by prospectus. |

Total Return Volatility

| Security Name | 30 Days | 90 Days | 180 Days |

|---|---|---|---|

| BMO Strategic Fixed Income Yield Fund | 3.35% | 4.32% | 5.77% |

| Iboxx USD Liquid High Yield Index TR | 1.98% | 4.95% | 4.01% |

| Iboxx USD Liquid Investment Grade Index TR | 5.83% | 7.42% | 7.21% |

| Bloomberg US Agg Total Return Index | 4.27% | 5.10% | 5.05% |

Source: Bloomberg. July 14, 2025. Historical volatility doesn’t tell you how volatile a Mutual Fund will be in the future and will change based on market conditions.

U.S. Government Yield Curve

Source: Bloomberg, July 14, 2025.

Reference Asset Exposure

Source: Bloomberg, July 14, 2025.

Yield vs. Contingent Coupon

BMO Strategic Fixed Income Yield: Yield reflects the contingent coupon of the structured rate swaps.

Disclaimer

No portion of this communication may be reproduced or distributed to clients.

Commissions, trailing commissions (if applicable) , management fees and expenses all may be associated with mutual fund investments. Please read the fund facts or simplified prospectus of the relevant mutual fund before investing. The indicated rates of return are the historical annual compounded total returns for the period indicated including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Distributions are not guaranteed and are subject to change and/or elimination.

For a summary of the risks of an investment in BMO Mutual Funds, please see the specific risks set out in the simplified prospectus.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

This material is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

The viewpoints expressed by the Portfolio Managers represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

Series F units are only available to investors who participate in eligible wrap programs or flat fee accounts with their registered dealers that have entered into a Series F Agreement with BMO Investment Inc.

*Portfolio holdings and allocations are subject to change without notice.

**All investments involve risk. The value of a Mutual Fund can go down as well as up and you could lose money. The risk of a Mutual Fund is rated based on the volatility of the Mutual Fund’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile a Mutual Fund will be in the future. A Mutual Fund with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect a Mutual Fund’s returns, see the BMO Mutual Fund’s simplified prospectus.

***As the fund is less than one year old, the actual Management Expense Ratio (MER) will not be known until the fund financial statements for the current fiscal year are published. The estimated MER is an estimate only of expected fund costs until the completion of a full fiscal year, and is not guaranteed.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain of the products and services offered under the brand name, BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations. BMO Financial Group is a service mark of Bank of Montreal (BMO).

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from Bank of Montreal. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the prospectus before investing.

Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

Commissions, trailing commissions (if applicable), management fees and expenses all may be associated with mutual fund investments. Please read the ETF facts, fund facts or prospectus of the relevant mutual fund before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. ETF Series of the BMO Mutual Funds trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

Distribution yields are calculated by using the most recent regular distribution, or expected distribution, (which may be based on income, dividends, return of capital, and option premiums, as applicable) and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value (NAV). Distributions are not guaranteed, may fluctuate and are subject to change and/or elimination. Distribution rates may change without notice (up or down) depending on market conditions and net asset value (NAV) fluctuations. The payment of distributions should not be confused with a BMO Mutual Fund’s performance, rate of return or yield. If distributions paid by a BMO Mutual Fund are greater than the performance of the investment fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a BMO Mutual Fund, and income and dividends earned by a BMO Mutual Fund, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

Distributions, if any, for all series of securities of a BMO Mutual Fund (other than ETF Series) are automatically reinvested in additional securities of the same series of the applicable BMO Mutual Fund, unless the securityholder elects in writing that they prefer to receive cash distributions. For further information, see the distribution policy for the applicable BMO Mutual Fund in the simplified prospectus.

Legal and regulatory disclosures

This information is for Investment Advisors only. By accepting, you certify that you are an Investment Advisor. If you are NOT an Investment Advisor, please decline and view the content in the Investor or Institutional areas of the site. The website is for informational purposes only and is not intended to provide a complete description of BMO Global Asset Management’s products or services. Past performance is not indicative of future results. It should not be construed as investment advice or relied upon in making an investment decision. Products and services of BMO Global Asset Management are only offered in jurisdictions where they may be lawfully offered for sale. The information contained in this Website does not constitute an offer or solicitation by anyone to buy or sell any investment fund or other product, service or information to anyone in any jurisdiction in which an offer or solicitation is not authorized or cannot be legally made or to any person to whom it is unlawful to make an offer of solicitation. All products and services are subject to the terms of each and every applicable agreement. It is important to note that not all products, services and information are available in all jurisdictions outside Canada.