BMO Strategic Equity Yield Fund – Biweekly Update

July 18, 2025

Portfolio Manager Commentary

As of July 14, 2025, the BMO Strategic Equity Yield Fund (BMO SEYF) reported a net asset value (NAV) of $9.50 and continues to deliver a compelling income profile with average yields in the 9.50% to 10.00% range.1 Structural buffers, active risk management, and a deliberate focus on capital preservation remain the foundation of our approach.

Positioning for Resilience in a Market Priced for Perfection:

Markets continue to climb, but the disconnect between price and fundamentals is widening. With valuations stretched and economic data softening, we remain cautiously optimistic—focused on income durability, capital preservation, and risk-adjusted returns. Structured products remain our preferred tool in this environment, offering attractive carry and embedded downside buffers.

Macro Landscape: Calm Headlines, Complex Undercurrents:

- U.S. equities have reached new highs, buoyed by resilient labor data and a temporary reprieve from tariff concerns. However, inflation pressures are expected to re-emerge as inventories normalize.

- Canada’s economy is cooling. Headline inflation softened to 1.7% YoY, and the BoC is expected to resume rate cuts in the fall. Labour markets remain tight but are showing signs of fatigue.

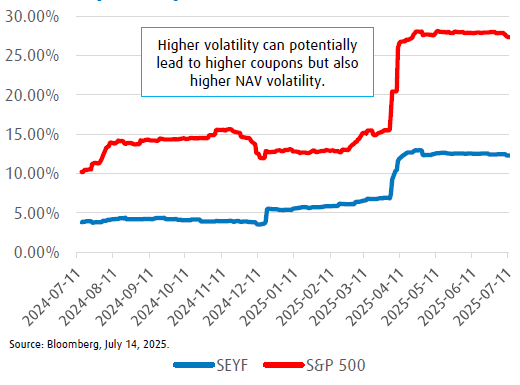

- Europe, while underrepresented in our portfolio, remains a region we are constructive on. Our lower allocation reflects structural product dynamics—specifically, lower equity volatility in European markets, which results in lower coupons on structured notes. This is a yield-driven decision rather than a reflection of our macro view. We continue to monitor European opportunities where fundamentals remain supportive.

- Volatility has normalized but yield curves are steepening and central banks are increasingly data-dependent— suggesting a more fragile backdrop than equity indices imply.

Portfolio Evolution: From Financials to Defensives:

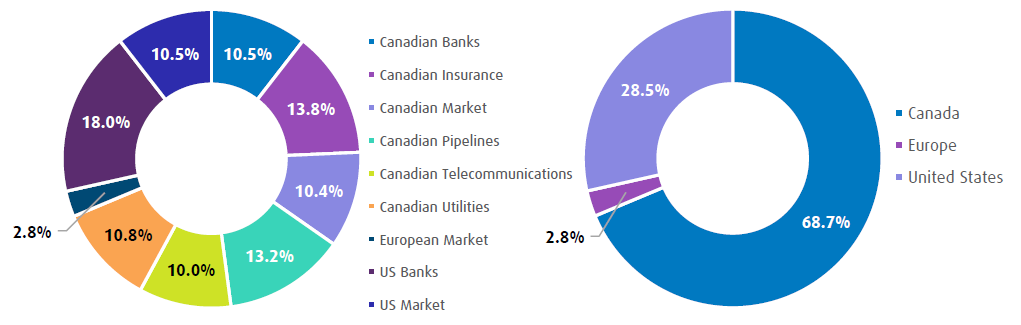

Over the past six months, we’ve made meaningful shifts in the portfolio to reflect the evolving macro and volatility regime. We’ve reduced exposure to banks—particularly in Canada—while increasing allocations to pipelines, utilities, and insurance.2 These sectors offer more stable cash flows and defensive characteristics, aligning with our focus on yield durability and downside protection.

We’ve also modestly trimmed broad market exposures in both Canada and the U.S. in favor of more targeted sector allocations and structured notes with deeper capital buffers.

Outlook: Selectivity Over Sentiment:

While markets may continue to drift higher, we believe the next leg will be harder won. With passive flows fading and fundamentals likely to reassert themselves, we’re leaning into strategies that are selective, defensive, and income-focused.

We’re not chasing the rally—we’re preparing for what comes next.

1Source: BMO GAM July 14, 2025. Past Performance is not indicative of future results.

2Allocations are subject to change without.

Fund Snapshot

| Coupon Range | Buffer Level Range |

|---|---|

| 9.50-10.00% | 20%-25% |

Distributions

| Previous | Upcoming |

|---|---|

| June 16, 2025 | August 18, 2025 |

Fund Characteristics

| Series | Fund Codes | MER (%)* |

|---|---|---|

| Advisor (CAD) | BMO99290 | 1.64 |

| F (CAD) | BMO95290 | 0.51 |

| **Low to Medium risk rating by prospectus. |

Volatility 90 Day

Top 10 Trades

| Reference Asset | Annualized Coupon | % of Overall Fund | Distance to Payment Threshold | Distance to Call (Positive is in the Money) |

|---|---|---|---|---|

| Canadian Pipelines | 10.65% | 1.55% | 16.24% | -8.76% |

| Canadian Insurance | 10.35% | 1.55% | 18.28% | -6.72% |

| Canadian Utilities | 8.80% | 1.55% | 19.55% | -0.45% |

| Canadian Insurance | 10.00% | 1.55% | 18.97% | -6.03% |

| Canadian Utilities | 9.07% | 1.55% | 20.36% | 0.36% |

| Canadian Insurance | 10.50% | 1.55% | 19.79% | -5.21% |

| Canadian Utilities | 9.55% | 1.55% | 21.40% | 1.40% |

| Canadian Insurance | 9.85% | 1.40% | 18.99% | -6.01% |

| Canadian Utilities | 9.25% | 1.40% | 25.86% | 0.86% |

| Canadian Market | 9.20% | 1.40% | 26.27% | 6.27% |

Source: BMO GAM July 14, 2025.

Reference Asset Exposure and Regional Exposure3

3 Reference Asset and Regional Exposure refer to the underlying benchmark exposure from the Total Return Swaps held by the Fund. Source BMO June 30, 2025. Holdings are subject to change without notice

Performance (total return) data as of June 30th, 2025.

Inception Date BMO SEYF: June 16, 2023. Inception Date BMO SFIYF: July 10, 2024

1 mo |

3 mo |

6 mo |

YTD |

1 yr |

SI |

|

BMO Strategic Equity Yield Fund Class A |

2.51 |

5.46 |

4.34 |

4.53 |

8.03 |

8.42 |

1 mo |

3 mo |

6 mo |

YTD |

1 yr |

SI |

|

BMO Strategic Equity Yield Fund Class F |

2.60 |

5.74 |

4.89 |

5.09 |

9.23 |

11.65 |

Disclaimer

No portion of this communication may be reproduced or distributed to clients.

Commissions, trailing commissions (if applicable) , management fees and expenses all may be associated with mutual fund investments. Please read the fund facts or simplified prospectus of the relevant mutual fund before investing. The indicated rates of return are the historical annual compounded total returns for the period indicated including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Distributions are not guaranteed and are subject to change and/or elimination.

For a summary of the risks of an investment in BMO Mutual Funds, please see the specific risks set out in the simplified prospectus.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

This material is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

The viewpoints expressed by the Portfolio Managers represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

Series F units are only available to investors who participate in eligible wrap programs or flat fee accounts with their registered dealers that have entered into a Series F Agreement with BMO Investment Inc.

*Portfolio holdings and allocations are subject to change without notice.

**All investments involve risk. The value of a Mutual Fund can go down as well as up and you could lose money. The risk of a Mutual Fund is rated based on the volatility of the Mutual Fund’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile a Mutual Fund will be in the future. A Mutual Fund with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect a Mutual Fund’s returns, see the BMO Mutual Fund’s simplified prospectus.

***As the fund is less than one year old, the actual Management Expense Ratio (MER) will not be known until the fund financial statements for the current fiscal year are published. The estimated MER is an estimate only of expected fund costs until the completion of a full fiscal year, and is not guaranteed.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain of the products and services offered under the brand name, BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations. BMO Financial Group is a service mark of Bank of Montreal (BMO).

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from Bank of Montreal. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the prospectus before investing.

Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

Commissions, trailing commissions (if applicable), management fees and expenses all may be associated with mutual fund investments. Please read the ETF facts, fund facts or prospectus of the relevant mutual fund before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. ETF Series of the BMO Mutual Funds trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

Distribution yields are calculated by using the most recent regular distribution, or expected distribution, (which may be based on income, dividends, return of capital, and option premiums, as applicable) and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value (NAV). Distributions are not guaranteed, may fluctuate and are subject to change and/or elimination. Distribution rates may change without notice (up or down) depending on market conditions and net asset value (NAV) fluctuations. The payment of distributions should not be confused with a BMO Mutual Fund’s performance, rate of return or yield. If distributions paid by a BMO Mutual Fund are greater than the performance of the investment fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a BMO Mutual Fund, and income and dividends earned by a BMO Mutual Fund, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

Distributions, if any, for all series of securities of a BMO Mutual Fund (other than ETF Series) are automatically reinvested in additional securities of the same series of the applicable BMO Mutual Fund, unless the securityholder elects in writing that they prefer to receive cash distributions. For further information, see the distribution policy for the applicable BMO Mutual Fund in the simplified prospectus.

Legal and regulatory disclosures

This information is for Investment Advisors only. By accepting, you certify that you are an Investment Advisor. If you are NOT an Investment Advisor, please decline and view the content in the Investor or Institutional areas of the site. The website is for informational purposes only and is not intended to provide a complete description of BMO Global Asset Management’s products or services. Past performance is not indicative of future results. It should not be construed as investment advice or relied upon in making an investment decision. Products and services of BMO Global Asset Management are only offered in jurisdictions where they may be lawfully offered for sale. The information contained in this Website does not constitute an offer or solicitation by anyone to buy or sell any investment fund or other product, service or information to anyone in any jurisdiction in which an offer or solicitation is not authorized or cannot be legally made or to any person to whom it is unlawful to make an offer of solicitation. All products and services are subject to the terms of each and every applicable agreement. It is important to note that not all products, services and information are available in all jurisdictions outside Canada.