8 Ways to Get Out in Front of Tax Season – and Set Up Clients for Success

Tax expert John Waters provides a practical list of tax tips and reminders that Advisors should use NOW to help clients plan strategically and maximize their after-tax returns.

October 2019

John Waters

CPA, CA, CFP, TEP, Vice President, Director of Tax Consulting Services, BMO Wealth Planning & Advisory Services

Read bioJohn Waters, Vice President, Director of Tax Consulting Services, BMO Wealth Planning & Advisory Services, shares important year-end tips and resources to help you structure ongoing planning conversations with your clients, and increase awareness of strategies to potentially reduce their tax burden – preparing you for a successful 2020.

Tax Season Shouldn’t Be Taxing: Start Planning NOW

Another month. Another tax conundrum. Though “tax season” ends in April, Canadians are overwhelmed by the nuances of taxation year-round – from when and how much to contribute to RRSPs, to the finer points of tax-loss harvesting, capital gains tax and foreign reporting. This creates an enormous opportunity for Advisors to add value for their clients – in partnership with tax specialists – by helping them navigate the complexities 12 months of the year, while keeping track of any tax law changes that may open up new avenues.

To help accomplish this, we’ve created a year-end checklist that every Advisor can use NOW as a tool for strategic planning conversations, ensuring no stone is left unturned in 2019. Not only could your proactivity save time and money (in taxes and accounting bills) for your clients, it will also serve to deepen the relationship and engender trust for the journey ahead.

Essential Tax Reading: 8 Ways to Minimize the Burden for Clients

- Consider tax-loss selling opportunities – Before fall hastily turns into winter, recommend a review of clients’ non-registered investment portfolios, and consider a sale of any securities with accrued losses to offset any capital gains realized during the year – or the three previous taxation years (if a net capital loss is created in the current year). It’s important to ensure that “harvesting” makes sense from an investment perspective, since stocks sold at a loss cannot be repurchased until at least 31 days after the sale to be effective, under the Superficial Loss Rule.

! Note that Friday, December 27 is the last possible buy/sell date for most securities to settle in the calendar year for tax purposes (based on the cycle of trade date plus two business days). For a more detailed understanding of this strategy, consult the BMO Nesbitt Burns article, titled Understanding Capital Losses.! Remember that capital gains or losses on foreign securities denominated in another currency are calculated in Canadian dollars, even if the sales proceeds remain in the foreign currency. Fluctuations in the foreign exchange rate over the period of ownership will therefore factor into the analysis for tax-loss selling.

Make ALL charitable donations (including those planned for early next year) by December 31 – Aside from the fast-approaching deadline to make donations eligible for claim in 2019, you may have clients for whom donating appreciated publicly-traded securities (instead of cash) is a consideration, potentially eliminating capital gains tax. For donations that exceed $200, the federal tax credit is calculated at the new top 33% marginal rate, but only on the portion of donations made from income that is subject to the new top marginal tax rate. For any donations made in excess of $200 where the individual’s taxable income is less than $200,000, a 29% federal tax credit will apply, which was the previous top federal marginal tax rate. Canadians can also choose to carry forward their donation credit for up to five years.

Discuss, determine and deduct– Encourage client awareness of all available deductions and credits (accessible on the CRA website) by discussing monthly expenses, and use this to jumpstart bigger planning conversations where you can add more value, such as the need for greater tax efficiency and cash flow.

! Note that December 31 is also the final payment date in order to receive a 2019 tax deduction or credit for expenses such as childcare, medical and tuition. Keep in mind that the maximum dollar amounts that can be claimed under the Child Care Expense deduction are generally $8,000 per child under age 7, and $5,000 per child aged 7 to 16.Maximize tax-deferred savings through an RRSP or TFSA – Instead of waiting until the deadline, suggest getting out ahead for extra tax-deferred growth. By making a 2019 RRSP contribution now, instead of the March 1, 2020 deadline, the money can grow tax-deferred in the RRSP for an extended period. Similarly, advise clients planning TFSA withdrawals in the near future to do so in December instead of waiting until the new year, so the amount withdrawn is added back to their TFSA contribution limit on January 1, 2020 (rather than 2021).

! As a reminder: clients that turned 71 years of age in 2019 must collapse their RRSP by the end of the year, and should consider making a final contribution to the extent there is any unused room.

RRSP & TFSA Contribution Limit

RRSP contribution limit – 18% of previous year’s earned income to a maximum of:

| 2019 – $26,500 |

| 2020 – $27,230 |

| 2021 – Indexed to average wage growth |

TFSA contribution limit

| 2019 – $6,000 |

| 2020 – $6,000* |

| * Subject to possible $500 increase due to indexing. |

Source: Wealth Planning Facts & Figures – 2019, BMO Wealth Management.

5. Meet final quarterly tax installment deadline

– Avoid any potential non-deductible interest or penalties and mark December 15 on the calendar as the due date for the final quarterly income tax instalment, which many Canadian investors are required to make since tax is not deducted at source on investment income. Clients may be required to pay these instalments if their estimated net income tax payable for the year, and net payable for either of the two preceding years, exceeds $3,000 ($1,800 for Quebec residents).

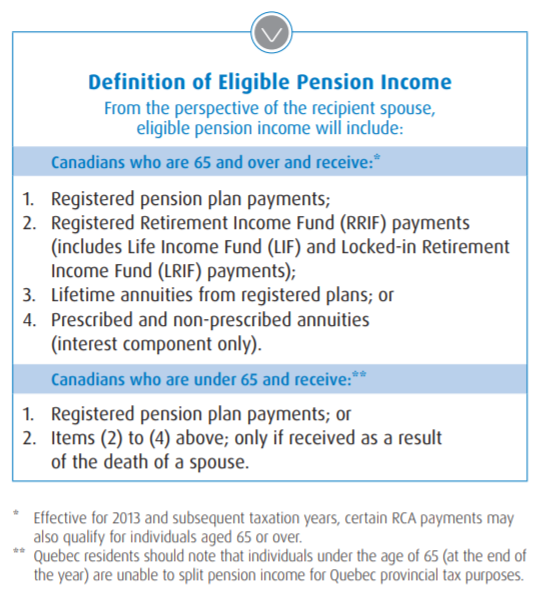

6. Cash in on pension income benefits – For your clients 65 or older in the decumulation phase, who aren’t already taking full advantage of the Federal Pension Income Tax Credit, consider converting a portion of their RRSP into a RRIF – and receive up to $2,000 of qualifying RRIF income before the end of the year to access this credit. Also be mindful of pension income-splitting legislation, which allows a transfer of up to 50% of eligible pension income to a spouse as a means to save on overall family tax.

7. Encourage rigorous record-keeping every month – Tax-planning is a year-round strategy, and requires foresight before you file. While keeping track of tax slips such as T4s, RRSP contributions and donation receipts is important, be sure to establish an open line of communication with your client’s tax advisor. It’s an excellent way to build and maintain a holistic picture of finances, keep abreast of any news in the tax world that could impact wealth plans, and to strengthen your own professional network.

8. Keep your ear to the ground NEXT WEEK – Tax law changes can be introduced at any time, so it’s wise to keep tabs on any proposals in the works, especially following the 2019 Federal Election next week. The federal parties have all promised a myriad of tax changes, some of which could be implemented shortly after the election. Also keep a close eye on proposed legislation introduced earlier this year, which seeks to change Canada’s beneficial employee stock-option tax treatment, effective for options granted on or after January 1, 2020. The draft legislation, which will limit the current beneficial tax treatment on certain option grants, has not yet been enacted and could be impacted by the election outcome.

Tax law changes can be introduced at any time, so it’s wise to keep tabs on any proposals in the works, especially following the 2019 Federal Election next week.

Another new measure that originated from the 2019 Federal Budget was the Canada Training Credit, instituted to address barriers to professional development for Canadians by helping to cover up to half of eligible tuition and fees associated with training. The new refundable tax credit starts accumulating in 2019 and will be available to be claimed for expenses in respect of the 2020 taxation year.

As with all tax-related investment decisions, your clients should consult with a professional tax advisor to determine which unique strategies make sense for them.

To discuss investment solutions that offer greater tax efficiency, contact your BMO Global Asset Management Regional Sales Representative, and access the resources below.

BMO Wealth Management Disclosure:

BMO Wealth Management provides this publication for informational purposes only and it is not and should not be construed as professional advice to any individual. The information contained in this publication is based on material believed to be reliable at the time of publication, but BMO Wealth Management cannot guarantee the information is accurate or complete. Individuals should contact their BMO representative for professional advice regarding their personal circumstances and/or financial position. The comments included in this publication are not intended to be a definitive analysis of tax applicability or trust and estates law. The comments are general in nature and professional advice regarding an individual’s particular tax position should be obtained in respect of any person’s specific circumstances. BMO Wealth Management is a brand name that refers to Bank of Montreal and certain of its affiliates in providing wealth management products and services. Not all products and services are offered by all legal entities within BMO Wealth Management. BMO Private Banking is part of BMO Wealth Management. Banking services are offered through Bank of Montreal. Investment management services are offered through BMO Private Investment Counsel Inc., an indirect subsidiary of Bank of Montreal. Estate, trust, planning and custodial services are offered through BMO Trust Company, a wholly owned subsidiary of Bank of Montreal. BMO Nesbitt Burns Inc. provides comprehensive investment services and is a wholly owned subsidiary of Bank of Montreal. If you are already a client of BMO Nesbitt Burns Inc., please contact your Investment Advisor for more information. All insurance products and advice are offered through BMO Estate Insurance Advisory Services Inc. by licensed life insurance agents, and, in Quebec, by financial security advisors. ® “BMO (M-bar Roundel symbol)” is a registered trade-mark of Bank of Montreal, used under licence. ® “Nesbitt Burns” is a registered trade-mark of BMO Nesbitt Burns Inc. All rights are reserved. No part of this publication may be reproduced in any form, or referred to in any other publication, without the express written permission of BMO Wealth Management.

BMO Global Asset Management Disclosures:

This article is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance. Any statement that necessarily depends on future events may be a forward-looking statement. Past performance is no guarantee of future results. Investments should be evaluated according to the individual's investment objectives. Professional advice should be obtained with respect to any circumstance.

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc., BMO Investments Inc., BMO Asset Management Corp., BMO Asset Management Limited and BMO's specialized investment management firms.

BMO Mutual Funds are offered by BMO Investments Inc., a financial services firm and separate entity from Bank of Montreal. BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from Bank of Montreal.

®/TM Registered trade-marks/trade-mark of Bank of Montreal, used under licence.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain of the products and services offered under the brand name, BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations. BMO Financial Group is a service mark of Bank of Montreal (BMO).

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from Bank of Montreal. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the prospectus before investing.

Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

Commissions, trailing commissions (if applicable), management fees and expenses all may be associated with mutual fund investments. Please read the ETF facts, fund facts or prospectus of the relevant mutual fund before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO Mutual Funds, please see the specific risks set out in the prospectus. ETF Series of the BMO Mutual Funds trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

Distribution yields are calculated by using the most recent regular distribution, or expected distribution, (which may be based on income, dividends, return of capital, and option premiums, as applicable) and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value (NAV). Distributions are not guaranteed, may fluctuate and are subject to change and/or elimination. Distribution rates may change without notice (up or down) depending on market conditions and net asset value (NAV) fluctuations. The payment of distributions should not be confused with a BMO Mutual Fund’s performance, rate of return or yield. If distributions paid by a BMO Mutual Fund are greater than the performance of the investment fund, your original investment will shrink. Distributions paid as a result of capital gains realized by a BMO Mutual Fund, and income and dividends earned by a BMO Mutual Fund, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

Distributions, if any, for all series of securities of a BMO Mutual Fund (other than ETF Series) are automatically reinvested in additional securities of the same series of the applicable BMO Mutual Fund, unless the securityholder elects in writing that they prefer to receive cash distributions. For further information, see the distribution policy for the applicable BMO Mutual Fund in the simplified prospectus.

Legal and regulatory disclosures

This information is for Investment Advisors only. By accepting, you certify that you are an Investment Advisor. If you are NOT an Investment Advisor, please decline and view the content in the Investor or Institutional areas of the site. The website is for informational purposes only and is not intended to provide a complete description of BMO Global Asset Management’s products or services. Past performance is not indicative of future results. It should not be construed as investment advice or relied upon in making an investment decision. Products and services of BMO Global Asset Management are only offered in jurisdictions where they may be lawfully offered for sale. The information contained in this Website does not constitute an offer or solicitation by anyone to buy or sell any investment fund or other product, service or information to anyone in any jurisdiction in which an offer or solicitation is not authorized or cannot be legally made or to any person to whom it is unlawful to make an offer of solicitation. All products and services are subject to the terms of each and every applicable agreement. It is important to note that not all products, services and information are available in all jurisdictions outside Canada.